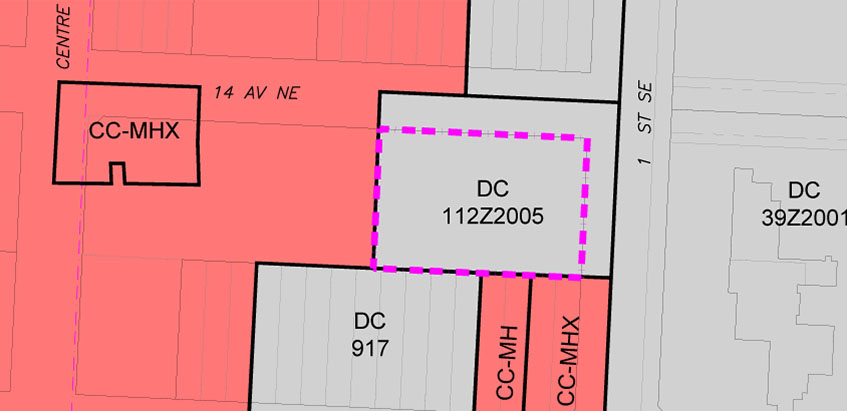

Good to know thanks! I reached out to someone from QP, and they mentioned they didn't know anything about a project or development plans, only that they wanted the land use done.I think this one was just a rezoning exercise to bring the parcel rules in line with the new land use bylaw (1P2007) as before it was based on the old one (2P80). There is a bit more of a description of why on Quantum Place's engagement website:

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Urban Development and Proposals Discussion

- Thread starter Surrealplaces

- Start date

artvandelay

Active Member

Interesting articles, thank for posting these.Today's article on rental demand, echoes many of the same ideas discussed on here for the past few years:

In Calgary, apartment building construction is booming as more Canadians embrace rentals

https://www.cbc.ca/news/canada/calgary/calgary-rental-apartment-construction-1.6648089

Apart from short-term interest rate/cost disruptions, I can't see any future where rentals don't continue to outpace ownership in Calgary. This is particularly true given our long-term deficit in rental supply compared to every other large Canadian city. More rentals will be good to see and an inevitable step to transitioning to a major city.

I actually think the boom in purpose-built rental housing is about to subside in Calgary, as it was primarily based on low interest rates over the past decade (combined with a sluggish economy). As both of those are no longer constant, we are likely to see an increase in condominium builds in the short to medium term.

TOD in Calgary has been abysmal, and the primary reason for that is not planning policy - it's capital cost. Large scale TODs like Westbrook and Anderson require the reintroduction of a street grid which means overhauling deep and shallow utilities. Developers are not going to bear these costs when there is property available across the street that isn't encumbered by these issues.Why post these articles together?

TOD. Why are all these people in the second article trying to make cross-town trips from Hawkwood or Ranchlands? Because the choices where people have to live is ridiculous if you want to take transit - "affordable" suburban apartments scattered randomly throughout all neighbourhoods - all at too low density and with zero mixed use - so you are condemned to have a low-frequency feeder bus with a transfer to a low-frequency main line LRT or MAX line. Outcomes are entirely predictable.

...

Transit and Calgary's planning needs to get it's act together - and soon. Every apartment building we put in a random, inaccessible by transit location is a missed opportunity and future transit critic that can't wait to be a driver.

- For Transit - changes need to address the culture of complacency and a bizarre/unchanging fixation on park-and-ride, despite it never proving to be material portion of ridership. Chop park-and-rides from the mandate entirely, replace with aggressive targets for increasing the population within 100m of a transit station.

- For planning - far more sweeping changes are needed than the incrementalism that powered our last round of urban redevelopment. Structural reform that actually incentivizes density in a transit-supportive distribution is needed. Endless car-capacity improvements eating up valuable transit-accessible land need to go too.

If the City is serious about TOD, they should front-end major capex in the same way they do for greenfield communities and have a property arm acting as master developer to get things moving (a la CMLC in East Village).

CalgaryTiger

Senior Member

You're speaking from a developers perspective, right? I could see higher interest rates from a potential condo buyers perspective pushing them to rent, not wanting to be locked into a purchase price and interest rate that could still go down. But I also think about someone who was thinking they might get a house/duplex/townhome now looking at buying a condo because their money doesn't go as far. But then maybe this person also bides their time, rents, and waits for the market to normalizeprimarily based on low interest rates

In summary, I still see a market for purpose-built rental development. But I also have no expertise in the subject.

If the City is serious about TOD, they should front-end major capex in the same way they do for greenfield communities and have a property arm acting as master developer to get things moving (a la CMLC in East Village).

I like it, who else is going to do it? You already have the expertise with CMLC. Problem is, how much of this can the market bare at once? Surely Developing Anderson wouldn't take people out of downtown but would likely compete with Greenfield condos. Westbrook seems too far down the tracks, there's a land owner there, they just seem more interested in sitting on the property, the city has already been working on 17th Ave SW improvements.

I firmly believe EV didn't create development that wouldn't happened, it robbed the West Village of development. Whether that's good or bad, I don't know. Without CMLC doing their thing the EV could've been in bad shape while the West Village has been fine but lacks new development.

zagox

Active Member

I’m not sure the idea is blue line spur, could be (eventual) green line extension plus people mover from green line to heavy rail station to airport.Taking the opportunity to make it look like you're driving something that's already happening. Not sure a C-train YYC link is better than a direct rail line to downtown. A spur off the blue line benefits only a few people, a direct line from downtown makes much more sense.

And not to take credit but I recall posting about using a Hydrogen powered train for the YYC, downtown, Banff line. It was my idea, no one else was thinking about it until I brought it up (sarcasm).

I am very skeptical of the one-seat heavy rail to the airport concept that Liricon proposed, I think they will find it’s way too expensive to do all the elevated track and station infrastructure given a constrained corridor with lots of curves and elevation changes required. I think it’s much more credible to end the heavy rail at Deerfoot and then have a people mover transfer from there.

Calgcouver

Senior Member

Regarding your point regarding interest rates and purpose-built rental development: demand is there for purpose-built rental developments and upward prices due to low vacancy rates will make PBR projects attractive to developers. Only thing is how rising interest rates affect profitability and how much the bank is willing to finance a PBR project. PBR started getting built in numbers again in Canadian cities when interest rates were at historic lows. Raising interest rates can compress cap rates on these projects, so the banks may not want to finance the projects even if demand is obviously there for new PBR projects. A healthy pool of institutional investors wanting to buy and hold the project also need to be present. If supply remains low, demand is high, interest rates stabilize and investors are present in the market that want to buy and hold these assets long-term, we will continue to see PBR projects get built in reasonably large numbers, so long as banks don't get too jittery about financing it.You're speaking from a developers perspective, right? I could see higher interest rates from a potential condo buyers perspective pushing them to rent, not wanting to be locked into a purchase price and interest rate that could still go down. But I also think about someone who was thinking they might get a house/duplex/townhome now looking at buying a condo because their money doesn't go as far. But then maybe this person also bides their time, rents, and waits for the market to normalize

In summary, I still see a market for purpose-built rental development. But I also have no expertise in the subject.

I like it, who else is going to do it? You already have the expertise with CMLC. Problem is, how much of this can the market bare at once? Surely Developing Anderson wouldn't take people out of downtown but would likely compete with Greenfield condos. Westbrook seems too far down the tracks, there's a land owner there, they just seem more interested in sitting on the property, the city has already been working on 17th Ave SW improvements.

I firmly believe EV didn't create development that wouldn't happened, it robbed the West Village of development. Whether that's good or bad, I don't know. Without CMLC doing their thing the EV could've been in bad shape while the West Village has been fine but lacks new development.

I also agree that TOD's that have City owned land surrounding them (Anderson being the best example) would be best served by having REDs partner with a group like CMLC, go in and invest in the infrastructure to create saleable, serviced and pre-zoned lots especially on surface parking lots adjacent to the station. Add some of the public realm improvements like in EV, so people see that there is some momentum and that the City has some skin in the game. Also keep densities sensible: make sure that the majority of the residential development remains as wood-frame, as the economics of it work in the short to medium term. Concrete, for-sale towers (or rental towers for that matter) will likely not be economical to build, so stop planning TODs to only be podium towers. Do some low and medium-rise developments and show you can actually do one TOD well and make it feel like a complete urban community like University District. Then people will see the benefit of TODs, but to-date, we only have a shitty patchwork of unfinished TOD projects to go on. Focus on completing a nice one at a lower scale that can be built out in short order, and also make affordable housing investments in that area as well. Give me TOD in Calgary at this scale:

Attachments

Last edited:

CalgaryTiger

Senior Member

demand is there for purpose-built rental developments and upward prices due to low vacancy rates will make PBR projects attractive to developers.

Here are your upward prices... If demand continues to exceed rental supply and condo prices come down, it could be better to buy. As long as you trust the condo market doesn't go down much further.

Last edited:

DougB

Senior Member

At some point interest rates will push both renting and owning to unaffordable levels, which will put downward pressure on land prices, government fees and property taxes. I suspect land prices will dip signficantly.

Here are your upward prices... If supply continues to exceed rental demand and condo prices come down, it could be better to buy. As long as you trust the condo market doesn't go down much further.

CalgaryTiger

Senior Member

Are we not already seeing prices dip, hopefully things don't fall off a cliff... But to your point about property taxes, I'm curious how fast the city adjusts home values. I know they claim to be set by the market but maybe they can lag their numbers to keep money coming in (I'll take my tinfoil hat off now).pressure on land prices, government fees and property taxes. I suspect land prices will dip signficantly.

I'm not sure we see renting and owning become unaffordable here in Calgary because of interest rates. Renting, I think is more likely to go up because you either have developers or land lords mortgages going up and they'll pass that cost on. But owning, are we not seeing prices already dip; so maybe your money might not go as far in buying (because of interest rates) and you end up in smaller, cheaper place but it's still more economical than paying rising rent?

DougB

Senior Member

The downward pressure on taxes is not due to falling land values. As assessed values decline, the mill rate increases. Citizens will not tolerate tax increases when their personal budgets are under stress. The same thing happened in the early to mid 90's inflation uptick.Are we not already seeing prices dip, hopefully things don't fall off a cliff... But to your point about property taxes, I'm curious how fast the city adjusts home values. I know they claim to be set by the market but maybe they can lag their numbers to keep money coming in (I'll take my tinfoil hat off now).

I'm not sure we see renting and owning become unaffordable here in Calgary because of interest rates. Renting, I think is more likely to go up because you either have developers or land lords mortgages going up and they'll pass that cost on. But owning, are we not seeing prices already dip; so maybe your money might not go as far in buying (because of interest rates) and you end up in smaller, cheaper place but it's still more economical than paying rising rent?

Calgary will stay affordable. As physical items like materials rise in cost against falling consumer budgets (due to higher rates), the only relief valves are land prices and taxes.

CalgaryTiger

Senior Member

So the only way to actually pay less taxes is for the values in your specific area to go down while other areas increase enough to not incentivize the city to raise the mill rate.As assessed values decline, the mill rate increases.

This is purely a guess but maybe the only places I see that happening is suburbs built from 2000-2010 simply because they're old and outdated enough (without a renovation) and close enough to new suburbs (that developers incentivize) that if you're going to buy out there you might as well buy new. Which drives the price of the older suburbs down. But I don't actually know if that theory is real or just in my head.

MichaelS

Senior Member

If your property decreases in value more than most, you will see a decrease. Conversely, if your property increases less than most, you will also see a decrease. That is a very simple way of explaining it.So the only way to actually pay less taxes is for the values in your specific area to go down while other areas increase enough to not incentivize the city to raise the mill rate.

This is purely a guess but maybe the only places I see that happening is suburbs built from 2000-2010 simply because they're old and outdated enough (without a renovation) and close enough to new suburbs (that developers incentivize) that if you're going to buy out there you might as well buy new. Which drives the price of the older suburbs down. But I don't actually know if that theory is real or just in my head.

Another way it could go down would be if Council decided to collect less, but I don't think we can expect that to happen.

DougB

Senior Member

Council will be under extreme pressure to keep tax increases below inflation, which is why tightening the vice grips on municipal employees will be essential.If your property decreases in value more than most, you will see a decrease. Conversely, if your property increases less than most, you will also see a decrease. That is a very simple way of explaining it.

Another way it could go down would be if Council decided to collect less, but I don't think we can expect that to happen.

MichaelS

Senior Member

Will they be under pressure? No election for years, this 4-year budget they vote on next week is their opportunity to implement their vision, with the longest stretch of time until they "might" face actual pressure.Council will be under extreme pressure to keep tax increases below inflation, which is why tightening the vice grips on municipal employees will be essential.

O-tac

Active Member

I noticed excavation and construction fencing in Seton across from the twin Marriotts. Anyone know if something is finally moving ahead in that dirt lot?

Patrick.1980

Active Member

I don’t know where the Marriott hotels are, but the project might be listed on the skyrise map https://calgary.skyrisecities.com/map/I noticed excavation and construction fencing in Seton across from the twin Marriotts. Anyone know if something is finally moving ahead in that dirt lot?

Right now only showing three developments.